SC Ventures invests in BTO

The strategic investment will fuel BetterTradeOff’s expansion into key markets in Asia and beyond.

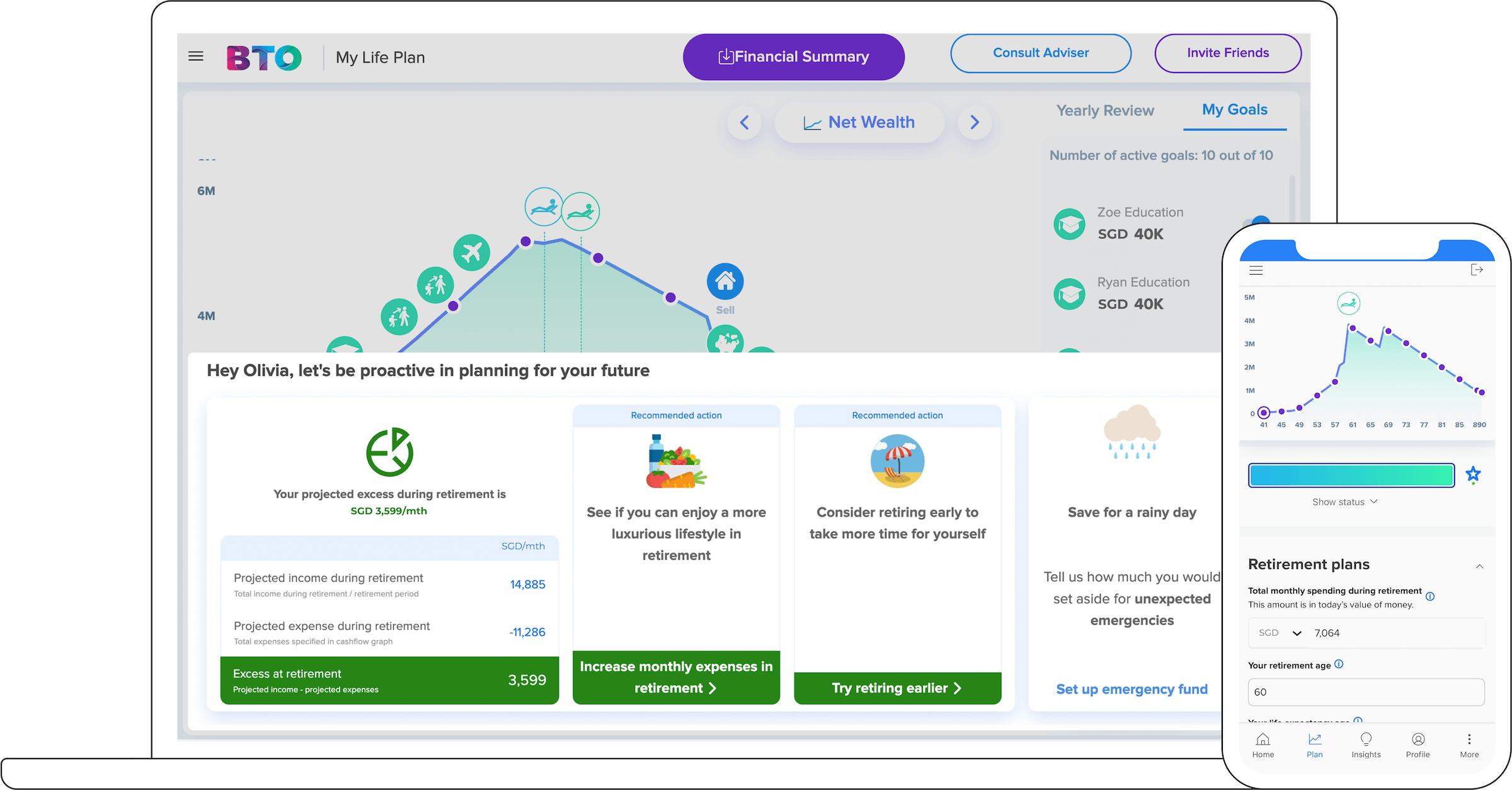

The only truly global financial planning platform

Our API-based architecture leverages advanced statistical models enabling financial institutions to configure and deploy a bespoke financial planning solution in just three months.

We simplify and demystify financial planning

We dramatically simplify the process of building a sound and comprehensive financial plan, for both advisers and consumers, making healthy financial futures a possibility for everyone.

Backed by industry leaders

“I haven’t yet seen another software capable of doing the same thing”

Michael Khosrowpour, Financial Advisory Director, PromiseLand

Enterprise Financial Planning Solutions

BetterTradeOff in the news

SC Ventures invests in BetterTradeOff to boost digital wealth advisory capabilities

The strategic investment will fuel BetterTradeOff’s expansion into key markets in Asia and beyond.

Leading European financial services provider invests in BTO global expansion

Dutch Financial Services Provider, Achmea, has completed a minority investment in BetterTradeOff via the Achmea Innovation Fund.

Standard Chartered partners FinTech BetterTradeOff to offer new online financial planning solution

Online tool simulates different financial scenarios and provides options to build a highly comprehensive personal plan in minutes.

Read moreBT Money Hacks: Building a solid personal finance plan

BTO's Laurent Bertrand talks to BT about how solutions like ours can make financial planning less complicated in these increasingly complicated times.

Zurich Malaysia Partners Singaporean Fintech to Simplify Financial Planning

Zurich Malaysia and Singapore-based fintech BetterTradeOff, launch Up | MyZurichLife, a financial planning solution exclusively for MyZurichLife’s users to help them plan their finance.

Read moreBetterTradeOff Co-Founder and CEO Laurent Bertrand live on Ticker News

BetterTradeOff's CEO talks about financial lessons from the pandemic and how BetterTradeOff aims to help with an online solution that simplifies the task of building a sound and comprehensive financial plan.

Laurent Bertrand, BTO Founder and CEO, on Money FM's Prime Time

Singapore Minister Alvin Tan doesn't expect that Singapore will be in recession next year. Prime Time speaks with Laurent Bertrand from BetterTradeOff to find out more.

BetterTradeOff: Taking the pain out of financial planning

The Singapore-based startup’s user numbers rose sharply during Covid-19. It wants to raise $11.5m by year-end, is planning a launch in Australia and is eyeing the US market

Read moreHow will your finances look like in 10, 20, 30 years? There are apps for that

In this digital age, financial planning apps have emerged as a way to offer more tailored and interactive advice to the masses.

Read moreBetterTradeOff CEO Laurent Bertrand on Biztech.asia

BetterTradeOff Co-Founder and CEO Laurent Bertrand talks about how BetterTradeOff is using technology to democratise financial planning.

Making money habits visual is the heart of this FinTech

Laurent Bertrand, BTO Founder and CEO, speaks with MoneyFM's Michelle Martin

Read moreFintech Start-up Has Holistic Life-planning Solutions For Everyone

An interview with BTO Co-Founder and CEO Laurent Bertrand.

Read moreBetterTradeOff wins the Global FinTech Hackcelerator 2018 at Singapore FinTech Festival

Out of 20 finalists, BTO is crowned the winner at Singapore FinTech Festival 2018.

Read moreMeet Up: a financial Planning platform to help you manage your money

Financial planning. Two words to the average millennial, at best, spark disinterest, and at worst, causes anxiety.

Read more

A one-of-a-kind platform for both advisers and consumers

We simplify the task of building a sound and comprehensive financial plan for both advisers and consumers.

Do-it-yourself financial planning

Up enables users to reimagine the future and unleash new possibilities through better financial decisions.

Digital planning for financial advisers

Up Adviser helps financial advisers demonstrate the value of their advise and build trust through transparency.

Financial planning solutions for institutions

Innovative solutions to drive deeper customer engagement, improve lead generation and increase sales.

Best in class data security

Protecting our customers’ data is a top priority. That’s why we've implemented the necessary policies and controls to achieve SOC 2 compliance, the gold standard of data protection. And with the help of Drata, continuously monitor our controls and maintain compliance over time.

The solution digitised what I've been doing using an Excel spreadsheet.

Ang Kok Chin

Financial Advisory Director, Financial Alliance

This helps WYNNES in a test project – '30 under 30’ – to engage in a conversation with millennials, who are the next generation of our senior clients.

Carol Seah

Founder & CEO, WYNNES Financial Advisers

It provided a better understanding of client needs and their potential returns for retirement planning.

David Wee

Manager Distribution, Finexis

The client was very impressed with the platform. It made explanation and planning very easy to articulate!

Mahalingam Saravanan

Associate Director Business Development, JPara Solutions

I told him rather than show him various retirement plans, I could go through his financial status and do holistic planning for his family, for him to have a better picture.

Philip Ong Kheng Leong

Director, Ray Alliance

It’s able to give clients a more holistic and complete financial planning experience, especially a non-bias point of view.

Stanley Sum

Senior Financial Consultant, SingCapital

The Digitalising Financial Advice Report

Learning we've gained from multiple projects with banks and insurers shows that a hybrid advice model – where consumers and advisers can plan together on the same platform – is most effective in driving engagement and sales.

Globally recognised

Brighter futures

Making a difference by enabling UN Social Development Goals through financial inclusion and empowerment.